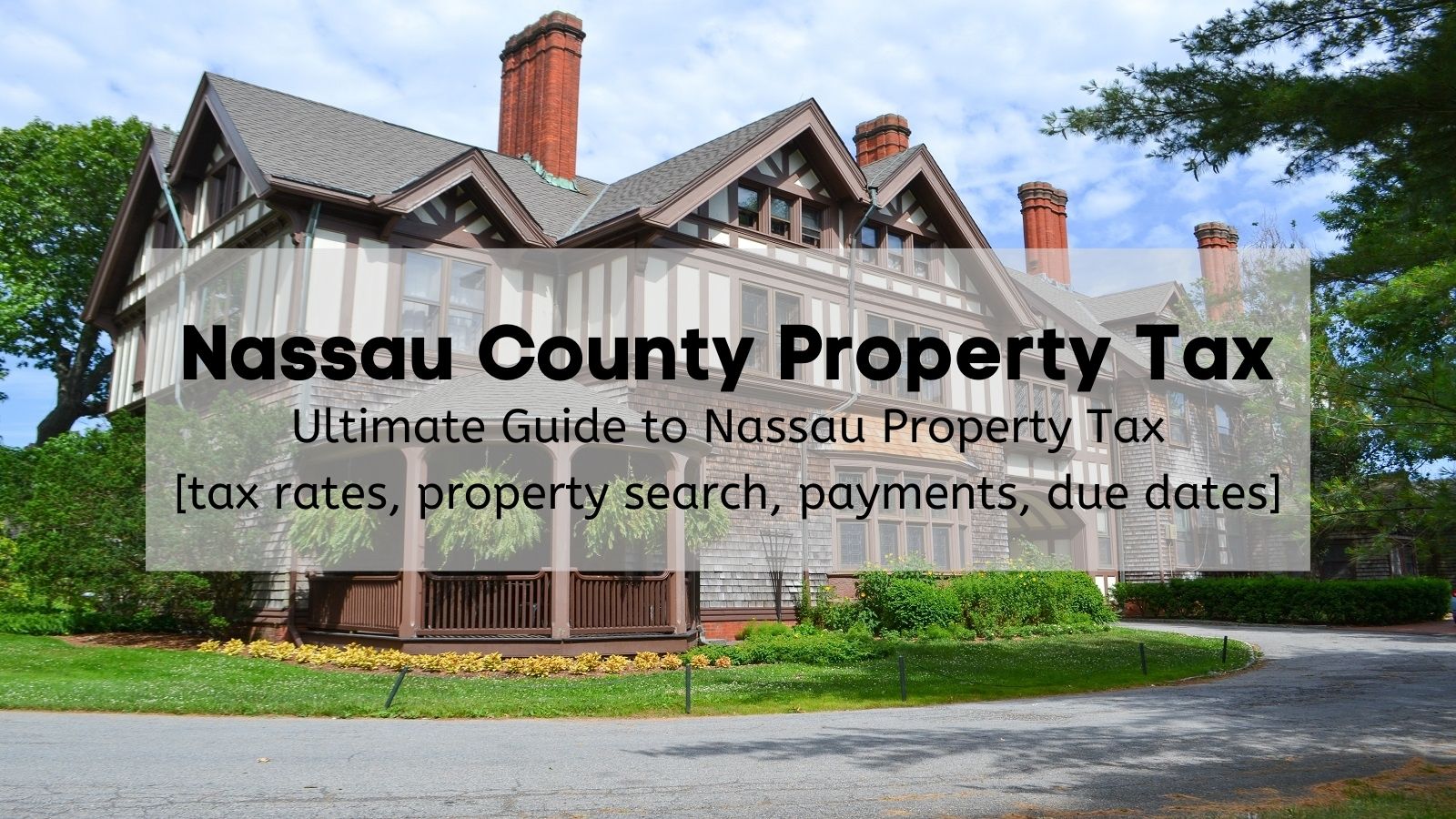

nassau county property tax rate 2020

Last summer the County posted a hypothetical. Your share of the taxes that will be raised for school and general municipal purposes in your community is based on an annual property assessment.

Florida Dept Of Revenue Property Tax Data Portal

The McCarthys were thrilled to buy their 800000 house in MassapequaIt.

. CBSNewYork -- New property assessments are in the mail for Nassau Countys 15 million residents and that. Nassau county property tax rate 2020 Wednesday August 24 2022 Edit. Access property records Access real properties.

How to Challenge Your Assessment. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. If the check amount.

Schedule a Physical Inspection of Your Property. 3 discount if paid in the month of December. Nassau County collects on average 074 of a propertys assessed.

Nassau County collects on average 179 of a propertys assessed. If you would like to schedule a physical inspection of your property please send an email to ncfieldnassaucountynygov or a letter to. On March 23 2020 the Nassau County Legislature passed the Reassessment Phase-In Act of 2020 RPIA formerly known as the Taxpayer Protection Plan.

Nassau County Tax Lien Sale. Payment by credit card will incur a convenience fee of 23 of your total tax payment. Complete guide covering the Nassau County property tax rate county town village school taxes due dates Nassau County property search payments more.

Without accounting for exemptions the Nassau property tax rate is 515 per 1000 of full value in 2021. You may pay your current tax bill by credit card or electronic check online. The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data district information tax maps property.

For over 10 months County Executive Curran has urged the Nassau County Legislature to call for a vote and finally approve the plan. The homeowners are stuck with shockingly high property taxes CBS2s Carolyn Gusoff reported. Assessment Challenge Forms Instructions.

If you have previously filed a tax grievance and have had a successful tax reduction for the 201819 or 202021 years Nassau County will not be using that information for deferment. 2022 Homeowner Tax Rebate Credit Amounts. Below are the homeowner tax rebate credit HTRC amounts for the school districts in your municipality.

4 discount if paid in the month of November. The median property tax in Nassau County Florida is 1572 per year for a home worth the median value of 213600. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863.

January 30 2020 528 PM CBS New York. 2 discount if paid in the month of January. This is the total of state and county sales tax rates.

Without accounting for exemptions the Nassau property tax rate is 515 per 1000 of full value in 2021 plus town taxes of 003 to 1805. What the RPIA Does. 1 discount if paid in the month of.

Calculate the Estimated Ad Valorem Taxes for your Property.

Nassau Property Tax Grievance Archives Page 4 Of 4 Property Tax Grievance Heller Consultants Tax Grievance

Tax Receiver Bills Are In The Mail Mid Island Times

By The Numbers Regional School Property Tax Growth Under The Tax Cap Rockefeller Institute Of Government

Where Do Homeowners Pay The Most In Property Taxes The Washington Post

Property Tax By County Property Tax Calculator Rethority

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Property Tax By County Property Tax Calculator Rethority

4 Options When Facing Back Property Taxes Nassau Suffolk County Ny

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

A Michael Hickox Nassau County Property Appraiser Yulee Fl Facebook

New York Property Tax Calculator Smartasset

Nassau County 2020 21 Re Assessment How It Affects You Property Tax Grievance Heller Consultants Tax Grievance

Audit Tax Appeal Firms Made 500m During Past Assessment Freeze Newsday

Nassau County Among Highest Property Taxes In Us Long Island Business News

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

The Tax Levy Limit When Is 2 Not Really 2

All The Nassau County Property Tax Exemptions You Should Know About