are political donations tax deductible uk

These donations are not tax deductible. The simple answer to whether or not political donations are tax deductible is no.

The Economic Arguments For And Against A Wealth Tax Adam 2021 Fiscal Studies Wiley Online Library

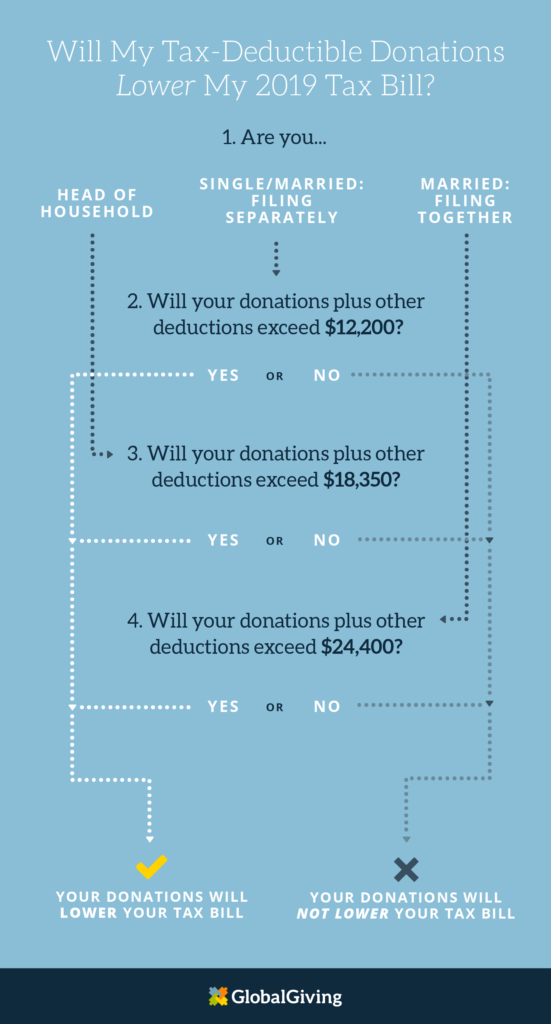

How this works depends on whether you.

. 1500 for contributions and gifts to independent candidates and members. However there are still ways to donate and plenty of people have been taking advantage of them over the past. Under the Political Parties Elections and Referendums Act 2000 PPERA which governs donations to political parties any contribution of more than 500 must come from a.

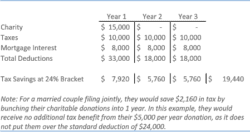

The tax goes to you or the charity. In general you can deduct up to 60 of your adjusted gross income via charitable donations 100 if the gifts are in cash but you may be limited to 20 30 or 50 depending. In other words you have an opportunity to donate to your candidate.

Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible. If you are not tax exempt and contributed charitable donations to a qualified organization you could claim a tax deduction. Though giving money to your candidate of choice is a great way to get involved in civic discourse donations to political candidates are not tax-deductible.

The most you can claim in an income year is. A business tax deduction is valid only for charitable donations. Also donations not money such as goods services effort and time.

Subscriptions for general charitable purposes and those to for example political parties are. While charitable donations are generally 75 of contributions up to 100. Things To Know.

To put it another way financial. These business contributions to the political organizations are not tax-deductible just like the individual. A donation to a federal state or.

Political donations are not tax deductible on federal returns. The IRS has clarified tax-deductible assets. However in-kind donations of.

To be precise the answer to this question is simply no. Donations by individuals to charity or to community amateur sports clubs CASCs are tax free. S341 Income Tax Trading and Other Income Act 2005 S541 Corporation Tax Act 2009.

If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. 1500 for contributions and gifts to political parties. This is called tax relief.

Regardless of what type of political donation it is the IRS does not take it into account for deductions. Are Donations to Political Campaigns Tax Deductible. Are political donations tax deductible uk.

According to the IRS. Is donation to political party tax deductible. Zee March 2 2022 Uncategorized No Comments.

Among those not liable for tax deductions are political campaign donations.

Frequently Asked Questions Giving What We Can

Are Political Contributions Tax Deductible Smartasset

The Tax Break Down Charitable Deduction Committee For A Responsible Federal Budget

Rules For Funding For Political Parties The Institute For Government

Understanding Tax Deductions For Charitable Donations

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Nonprofit Law In Ireland Council On Foundations

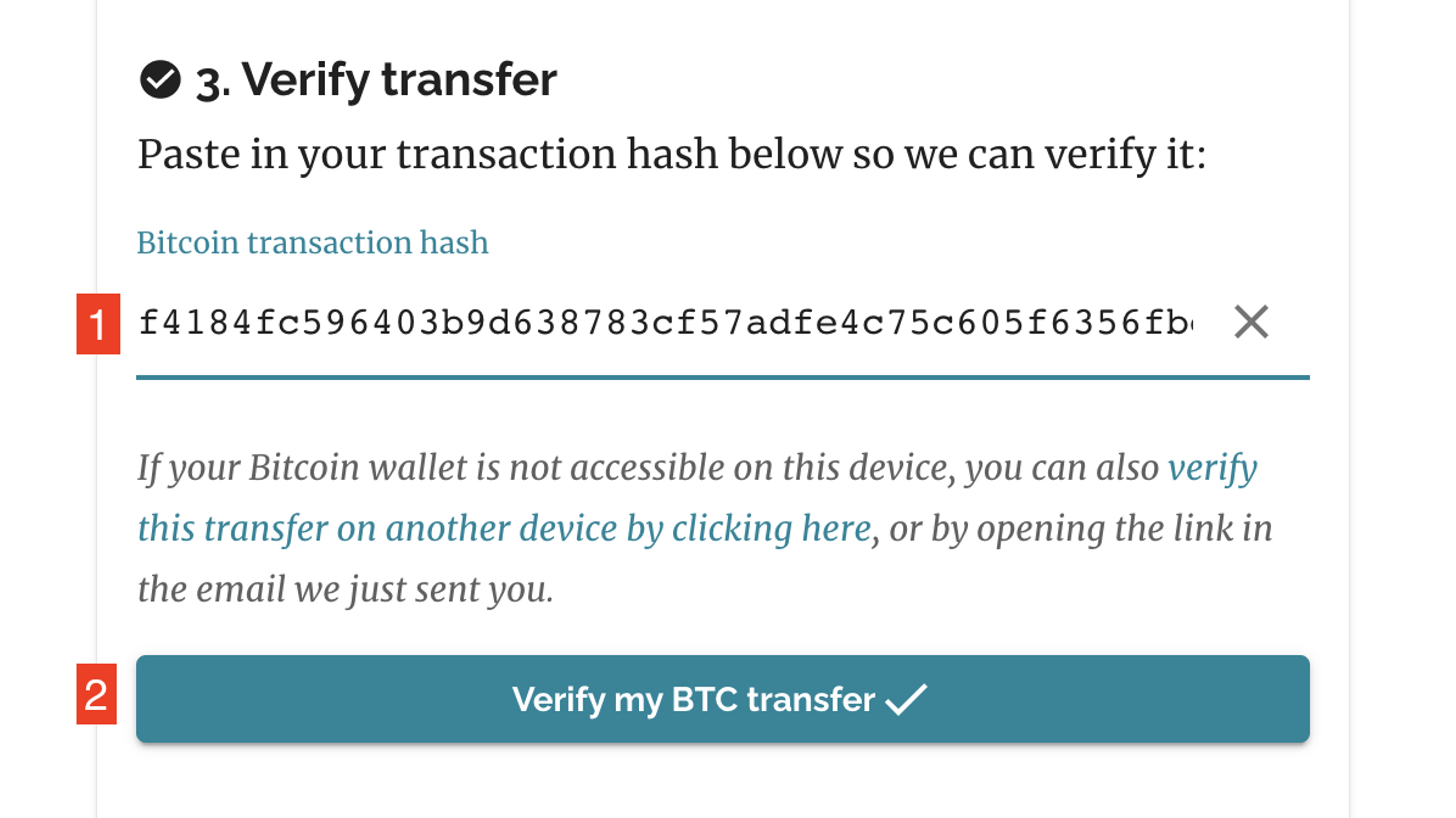

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

Tax Deductible Donations Rules For Giving To Charity Experian

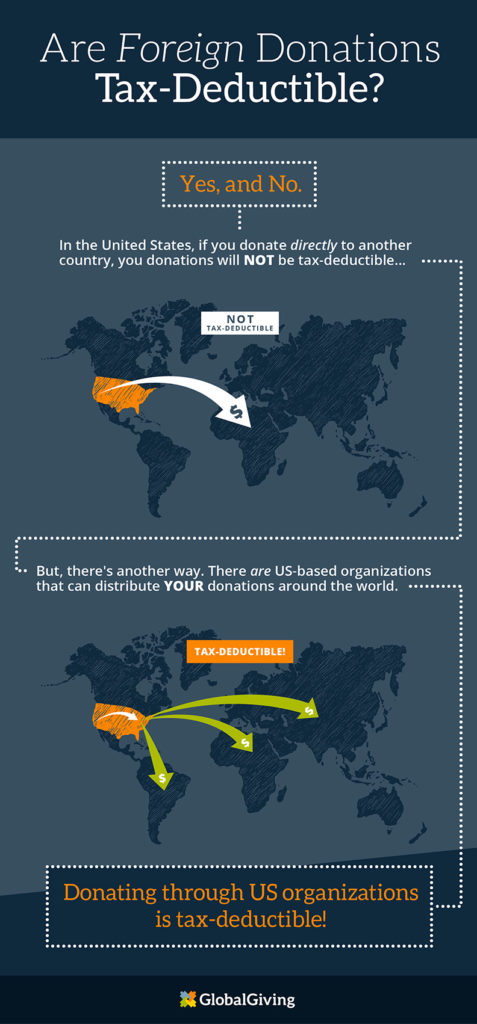

Tax Deductions For Donations In Europe Whydonate

Get A Tax Break Like A Billionaire On Your Political Donations Wsj

Get A Tax Break Like A Billionaire On Your Political Donations Wsj

2022 Car Donation Tax Deduction Information

Tax Deductions For Donations In Europe Whydonate

Donations Have Surged To A Scam Political Group That Claims To Help Police Officers Cnn

Are Political Contributions Tax Deductible H R Block

How To Take Advantage Of Donor Advised Funds And Special 2020 Tax Deductions For Donations